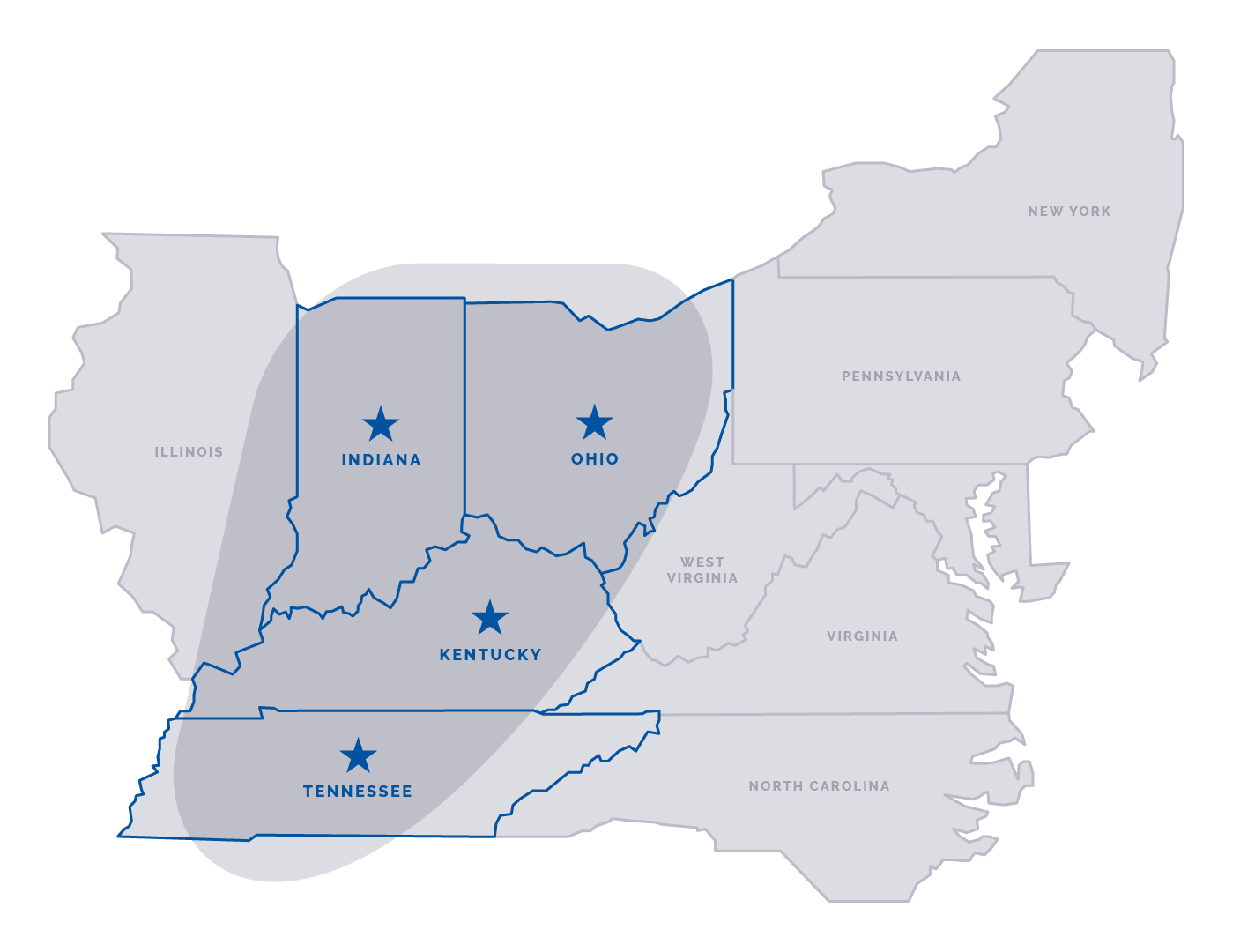

For over a decade, our consultant team of six experienced consultants has been delivering cost-effective risk management results for community banks. We have been partnering with community banks in Kentucky, Indiana, Ohio, and Tennessee since 1994, and we are confident about our proven performance for numerous banks in the region. Our firm has 150 years of experience to draw from when fulfilling your various consulting needs.

When you partner with PBC for your consulting needs, you’ll uncover early and accurate identification and improved risk management processes. With us being an independent firm, you eliminate the high fees that come from other consulting and accounting firms but still receive the benefits of experience and expertise.

Our senior personnel actually do the work, in contrast with most other firms that usually send out junior, sometimes inexperienced, personnel to perform the majority of services. Results count, so it’s integral to assign the job to someone with the necessary experience. Working with PBC is the most cost-effective way for community banks in Kentucky, Indiana, Ohio, and Tennessee to satisfy regulatory requirements. Giving them the peace of mind to know they are operating in a safe & sound manner.

When it comes to performance and expertise, our team is second to none. With us, you get the service and skills of our senior executives, who can be at your Bank and on the job for you. You’ll get a personalized approach from start to finish at an affordable price. Personalized service is our trademark, and satisfied clients are our best advertisement.

The PBC Team

Bob and Ray have a combined experience of more than 65 years. This expertise comprises substantial regulatory and management consulting, an extensive banking and small business background including but not limited to, auditing, lending, and branch/operations management. Their credit analysis, management consulting, and regulatory relations background include working with smaller community banks to large holding companies. They have been essential in helping nine banks out of regulatory enforcement action.

Our Compliance Team possesses superior banking backgrounds, which include a combined 70 years of experience in various roles, such as Compliance Officer, Chief Risk Officer, BSA Officer, Internal Auditor, and Human Resource Officer. Our team has helped ten different banks out of regulatory enforcement action.

On the IT side, Kevan is a well-rounded IT Professional. He is a Certified Information Security Auditor, Manager, Ethical Hacker, and Fraud Examiner. He has almost 20 years of hands-on experience working in Banking, Healthcare, and Insurance. He specializes in Auditing, Ethical Hacking & Cyber Security and bears the gift of clearly explaining arising issues to anyone, no matter your IT knowledge.

What are they saying?